Applying for the loan shouldn't affect your credit score.Īlways look at the interest rate.

The company's partner bank will review your application and may consider your tax payment history as well as review your credit report. You have to apply for the loan after you file your tax return, meaning you only get one shot at approval (you can't try out another tax preparer if you get denied). No-fee refund advance loans are available to filers who are 18 or older at H&R Block, TurboTax, and Jackson Hewitt. Where can I get an advance on my tax refund? In addition to that, Jackson Hewitt also offers an early refund advance option starting mid-December through mid-January. H&R Block and TurboTax, (in partnership with Credit Karma Money) offer refund advance loans from early January through various dates in February. How early can I get an advance on my tax refund?

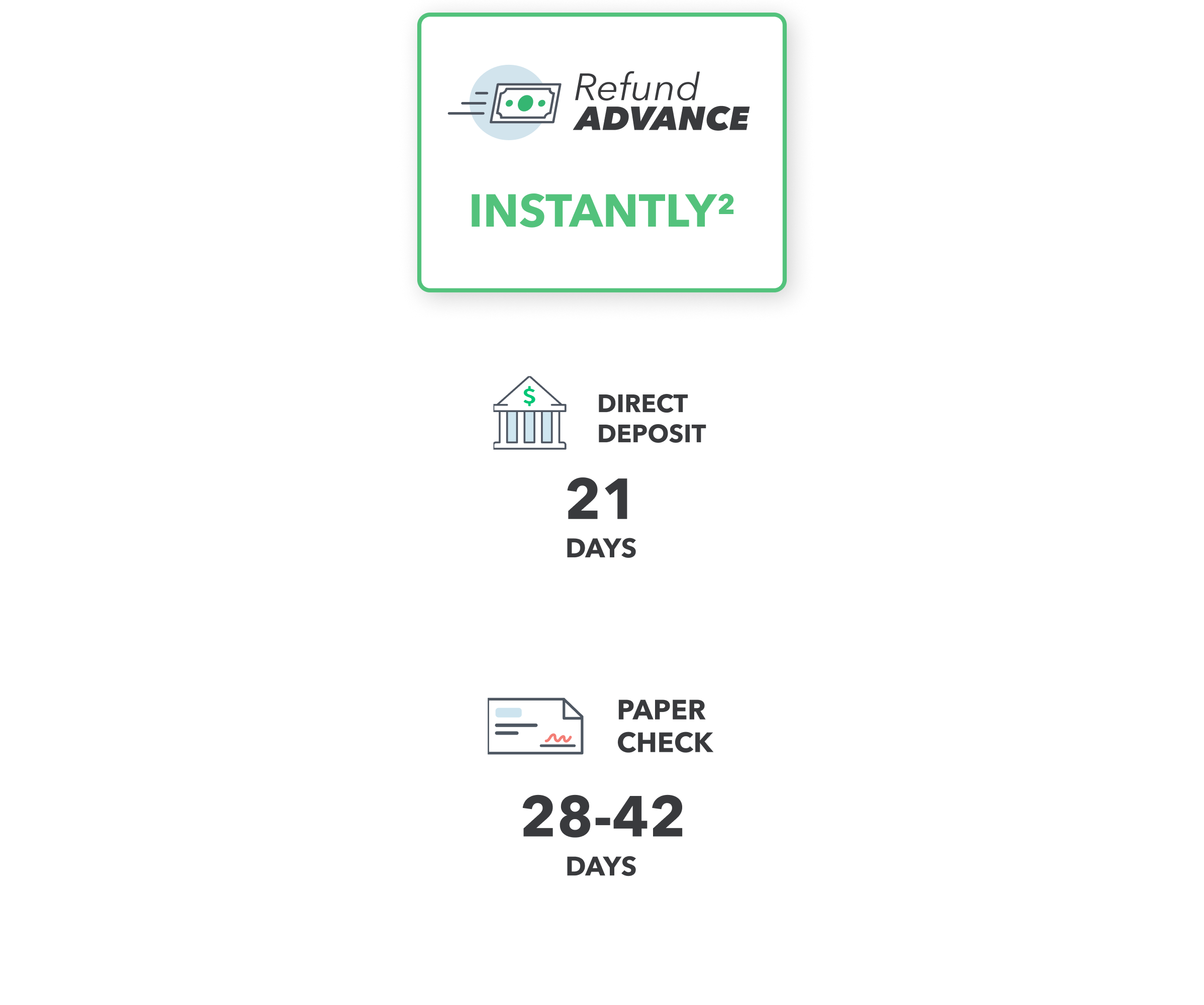

Later, the IRS will distribute your $3,000 refund to the lender, who will claim their $1,500 and send the rest to you. You apply for a refund advance loan and get approved for $1,500. Here's an example: You file your taxes and the tax preparer estimates your refund will be $3,000. When the IRS or your state tax agency distributes your refund, the lender will automatically be repaid the amount you borrowed and the remaining money will be sent to you. You can typically get up to half your refund amount early. If you're approved, you can get a lump sum loaded onto a debit card or deposited in your bank account, usually the same day. A few popular online tax preparers can help you get access to part of your tax refund on the same day you file.Ī tax refund advance is a short-term loan that gives you access to your cash sooner than the IRS or your state tax agency can get it to you. Luckily there's an option for anyone who's expecting a refund and doesn't want to wait. Specifically, taxpayers who claim the Earned Income Tax Credit or Additional Child Tax Credit can't expect their refunds before mid-February, no matter how soon they file. The IRS warns that while it expects to pay most refunds within 21 days, certain refunds are likely to take longer. In recent years, the pandemic upended normal operating procedures, pushing both the tax deadline and overall refund payout schedule back several months. The IRS generally delivers tax refunds speedily, paying out nine in 10 refunds within three weeks of receiving an electronic tax return (paper returns can take up to six weeks). By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept our

0 kommentar(er)

0 kommentar(er)